Gifts that reduce your taxes

Gifts that pay you income

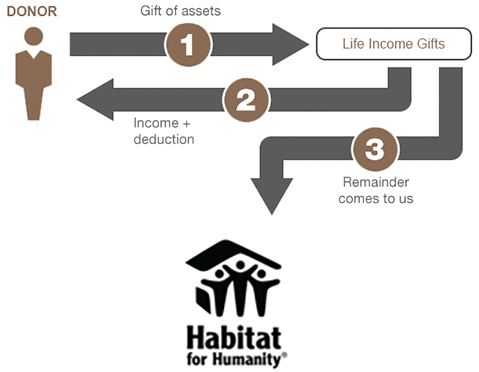

You can receive income for life while ensuring that families have access to safe and affordable housing.

If you are considering this type of gift, we recommend that you consult with your financial advisor and a gift planner at Habitat for Humanity.

Charitable gift annuities

This plan allows you to give a substantial donation to Habitat for Humanity while receiving tax-favored income for life. Charitable gift annuities offer attractive payout rates for those who want to receive income and provide families the opportunity to become self-reliant through safe, affordable housing.

Charitable remainder trust

You can receive income for life and reduce your taxes while supporting Habitat for Humanity by transferring assets to fund the trust. Not only does this pay income to you or your beneficiaries for life, but you also receive an income tax deduction the year you transfer assets to the trust. The remaining portion of the trust, after all payments have been made, goes to Habitat for Humanity.

Gifts that may reduce your taxes

Some legacy gifts made to Habitat for Humanity can have substantial tax savings.

Retirement plan gift

You can reduce or even eliminate tax liabilities on your retirement plan by naming Habitat for Humanity as direct beneficiary. The entire amount of your IRA, 401(k) or other retirement accounts may be taxed if you leave them to your heirs. Instead, consider giving them less tax-burdened assets like real estate and stock, and use retirement assets to create your legacy gift with Habitat.

Life insurance plan

Gifts of real estate

Gifts of stock

Savings bonds

Please contact us at plannedgiving@habitat.org or toll free at (833) 434-4438 if you have any questions.

Then, consult with your tax advisor and lawyer to determine which planned gift strategy is best for you.

I’m here to help!

Paul Fisher

Vice President of Individual Giving

Habitat for Humanity

plannedgiving@habitat.org

Toll free phone: 833-434-4438